SIM swapping is one of the fastest growing forms of identity theft—and the numbers prove it. According to the FBI, in 2023 they investigated 1,075 U.S. SIM swapping incidents, resulting in nearly $50 million in losses.

This scam works when criminals trick mobile carriers into transferring your phone number to their device. With it, they can intercept texts and calls, bypass SMS-based two-factor authentication, reset passwords, and take over your accounts—locking you out of your own digital life.

At Bison Security Co., we help families, small business owners, and public figures prevent these high-impact SIM swapping attacks. Below, we’ll explain how the scam works, why it matters, and what simple steps you can take to protect yourself today—no tech jargon required.

Table of Contents

- 0.1 Why SIM Swapping Works

- 0.2 Real-World Consequences of SIM Swapping

- 0.3 1. Signs You’re a Victim of a SIM Swapping Attack

- 0.4 2. How to Protect Yourself (or Your Family) from SIM Swapping

- 0.5 3. SIM Swap Protection for Small Businesses

- 0.6 4. What to Do if You’ve Been SIM Swapped

- 0.7 Final Thoughts: Your Phone Number Is a Key—Guard It Like One

- 1 Take Control of Your Digital Safety

Why SIM Swapping Works

SIM swapping is dangerous because it doesn’t require a hacker to break into your phone—it just requires them to convince your mobile carrier to hand it over.

Most people assume their phone number is safe because it’s linked to a physical device. But carriers like Verizon, AT&T, and T-Mobile allow your number to be moved to a new SIM card if someone claims to be you. That’s exactly what scammers exploit.

They might:

- Use phishing emails or fake customer service calls to gather personal details

- Pull information leaked in data breaches—like your birthday, address, or account numbers

- Call your provider while impersonating you, complete with just enough personal info to sound convincing

Once the SIM swap is approved, your phone instantly loses service—and the attacker’s device is now receiving your texts, calls, and two-factor authentication codes. From there, it’s a race to take over your email, bank, and social media accounts before you can react.

Real-World Consequences of SIM Swapping

A SIM swapping attack isn’t just a technical inconvenience—it can completely unravel your digital life in a matter of minutes.

Once a scammer takes control of your phone number, they can:

- Drain your bank accounts or investment apps

- Steal cryptocurrency from mobile wallets like Coinbase or Trust Wallet

- Hijack your email and social media accounts

- Access business-critical platforms like Microsoft 365, Slack, QuickBooks, or Zoom

- Lock you out of your accounts and demand ransom—or cause public embarrassment

- Damage your reputation, especially if you’re a business owner, public figure, or community leader

And because many services still send 2FA codes via text, SIM swapping often gives the attacker immediate access without needing your password. It’s fast, silent, and devastating.

1. Signs You’re a Victim of a SIM Swapping Attack

Recognizing the warning signs of SIM swapping early can make the difference between a minor disruption and a full-blown identity crisis. Here’s what to watch for:

- Your phone suddenly shows “No Service” or you can’t send/receive texts or calls—especially while others still have signal

- You’re unexpectedly locked out of important accounts, like email, banking apps, social media, or even business tools

- You receive password reset texts or emails that you didn’t request—indicating someone is trying to take control

- Friends or coworkers report strange messages or posts coming from your accounts

- Your authenticator app or security alerts are suddenly quiet—a sign your number may be reassigned

If something feels off, don’t dismiss it. SIM swapping attacks move fast, so trust your instincts and take immediate action.

2. How to Protect Yourself (or Your Family) from SIM Swapping

Preventing a SIM swapping attack starts with locking down the weak points scammers exploit. Here’s how to stay ahead of it:

Strengthen SIM Swap Protection with Your Mobile Carrier

Most SIM swaps succeed because scammers convince your carrier to transfer your number. Stop that by securing your account:

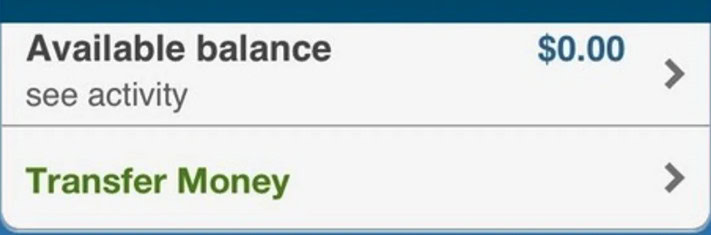

- Set up a unique PIN or password with your carrier account—it adds an extra verification layer

- Ask your carrier about “port-out protection” or SIM lock features—these prevent unauthorized transfers

- Avoid using your mobile number as a recovery method for sensitive accounts like email, banking, or crypto

Pro tip: Every major carrier (like Verizon, AT&T, T-Mobile) has different policies. Log in or call today to enable their SIM swap protection tools—it only takes a few minutes.

Use an Authenticator App Instead of Text Messages

Most people rely on text messages for two-factor authentication (2FA). But if a hacker controls your number, those codes go straight to them.

Instead, use a secure authenticator app, such as:

- Authy (great for families or multi-device support)

- Google Authenticator

- Aegis (open-source for Android users)

These apps generate one-time codes directly on your device—making them immune to SIM swapping attacks.

Security tip: Back up your authenticator or store recovery codes safely in case you lose your phone.

Lock Down Personal Information Online

SIM swap scammers often collect personal information before they attack. The less they know, the safer you are.

- Remove yourself from people-search sites like Whitepages, Spokeo, and BeenVerified—these sites often list your phone, address, and relatives

- Avoid oversharing on social media (especially birthdays, pet names, school info, or vacation updates—common password clues)

- Use Bison Identity Monitoring to scan for your exposed data across the web and automate removal from data broker sites

Pro tip: Reducing your digital footprint is one of the most effective SIM swapping protection steps you can take today—especially for families or small business owners.

3. SIM Swap Protection for Small Businesses

SIM swapping isn’t just a personal threat—it’s a serious risk for small businesses. If you’re a business owner, there’s a good chance your phone number is tied to:

- Online banking or payroll accounts

- Customer portals or payment processors

- Invoicing or accounting apps like QuickBooks

- Social media platforms or scheduling tools

- Two-factor authentication (2FA) for internal software or email systems

That’s a lot of access tied to one number—which means a single SIM swapping attack could cripple operations, expose client data, or drain funds.

Best practices for business owners:

- Use a separate phone number just for business operations, preferably on a line with strong carrier protections (not your personal number)

- Assign a shared device with an authenticator app (like a company-managed phone or tablet) for MFA instead of relying on an individual employee’s number

- Document all SIM swap protection steps in your cyber safety manual to ensure consistent use across the team

- Limit the number of people with access to critical logins, and use role-based permissions whenever possible

If you’re using your personal phone number to manage your business—it’s time to rethink it. SIM swapping has already cost small business owners millions in financial and reputational damage.

4. What to Do if You’ve Been SIM Swapped

If you suspect you’re the victim of a SIM swapping attack, every second counts. The faster you respond, the more you can limit the damage.

Here’s what to do immediately:

- Call your mobile carrier and report the fraud.

- Let them know your number was taken over via SIM swapping, and request that they restore your number and lock your account from further changes.

- Change your passwords—fast.

- Prioritize your email, bank accounts, and any platforms tied to your phone number or business logins. Use strong, unique passwords with a password manager.

- Revoke device access.

- Go into your email, cloud storage, and social media accounts and sign out of all sessions or devices you don’t recognize.

- Switch to an authenticator app for MFA.

- Stop using SMS-based two-factor authentication, and switch to apps like Authy, Google Authenticator, or Aegis. This step can prevent future SIM swap attacks.

- Freeze your credit with all three major bureaus—Equifax, Experian, and TransUnion—to stop fraudsters from opening accounts in your name.

- Contact your bank or payment providers to lock down access, dispute transactions, or flag your account for fraud monitoring.

- File a police report and notify any impacted clients or partners—especially if business data or communications were compromised.

Pro Tip: Use a password manager like Bitwarden to quickly update and strengthen your logins. It also helps you avoid reusing passwords—one of the most common ways attackers stay in control after a SIM swap.

Final Thoughts: Your Phone Number Is a Key—Guard It Like One

Your phone number isn’t just for calls and texts—it’s a digital master key. From banking and email to social media and work apps, it’s often the first point of access for identity thieves.

SIM swapping is a growing threat because it targets that key. But you’re not powerless.

With proactive SIM swapping protection, stronger login habits, and the right tools—like authenticator apps and identity monitoring—you can keep your data safe and your digital life stress-free.

Take Control of Your Digital Safety

At Bison Security Co., we believe strong cybersecurity starts at home—and grows with you. Whether you’re a parent, professional, or small business owner, we’ve got your back with the tools and support you need to stay safe in a connected world.

Here’s How to Get Started:

- Protect Your Home Network — Learn about Bison SafeFilter and block threats before they reach your devices.

- Test Your Scam-Spotting Skills — Take our Family Phishing Quiz and see how ready your household really is.

- Stay Cyber-Smart — Subscribe to our newsletter for weekly safety tips, family-friendly checklists, and early alerts.

- Tune In to the Podcast — Coming soon: honest, practical conversations about digital safety for modern families.

Security That Stands Its Ground.