In today’s digital world, one small slip can lead to devastating financial consequences for your family. Whether it’s a hacked email account, a convincing fake invoice, or a sneaky scam targeting your kids or aging parents, cybercriminals are getting more sophisticated—and families are increasingly in the crosshairs.

Many of the worst breaches don’t start with elite hacking. They start with everyday missteps: weak passwords, oversharing, or clicking a single malicious link. That’s why knowing the most common online financial security mistakes is the first step toward building real protection.

At Bison Security Co., we help families spot and prevent online financial security mistakes before they become expensive lessons. This guide breaks down the most frequent missteps—and how to fix them fast to protect your finances, your identity, and your peace of mind.

Table of Contents

- 0.1 1. Reusing Passwords Across Banking and Shopping Sites

- 0.2 2. Using Text Messages for Two-Factor Authentication (2FA)

- 0.3 3. Trusting Emails or Messages Asking for Money

- 0.4 4. Letting Devices Fall Behind on Security

- 0.5 5. Banking on Public Wi-Fi Without Protection

- 0.6 6. Clicking Links in Fake “Bank” or “Tax” Emails

- 0.7 7. Forgetting to Freeze Credit or Monitor Breaches

- 0.8 8. Weak Email Security (Your Most Important Account)

- 0.9 9. Leaving Kids and Parents Out of the Conversation

- 1 Bonus: Common Scams That Target Families

- 2 Final Thoughts: Strong Habits Save Dollars and Sanity

- 3 Take Control of Your Digital Safety

1. Reusing Passwords Across Banking and Shopping Sites

Why it matters:

One of the most dangerous online financial security mistakes families make is reusing the same password across multiple accounts. If your Netflix login is identical to your PayPal or bank account password, a single data breach can open the door to your entire financial life. Cybercriminals often test stolen credentials across popular sites in a tactic called “credential stuffing”—and it works alarmingly well when passwords aren’t unique.

Fix it:

Stop password reuse in its tracks by using a secure, family-friendly password manager like Bitwarden. These tools generate strong, unique passwords for every financial account and allow secure sharing with your spouse, teen, or trusted caregiver. Avoiding this common online financial security mistake is one of the simplest, most effective ways to prevent identity theft and account compromise.

2. Using Text Messages for Two-Factor Authentication (2FA)

Why it matters:

Relying on SMS for two-factor authentication is one of the most overlooked online financial security mistakes families make. While better than nothing, text-based 2FA leaves you vulnerable to SIM-swapping attacks—where hackers hijack your phone number by tricking your mobile provider. Once they have access to your SMS messages, they can intercept login codes and access your email, bank, and even cryptocurrency accounts without your knowledge.

Fix it:

Swap out SMS for a more secure method. Use a dedicated authenticator app like Authy or Google Authenticator to generate time-based codes that live on your device and can’t be intercepted. Prioritize securing your primary email, banking apps, and payment tools first—these are the top targets. Avoiding SMS-based 2FA is one of the smartest ways to eliminate a common online financial security mistake before it costs you.

3. Trusting Emails or Messages Asking for Money

Why it matters:

One of the most common online financial security mistakes families make is assuming a message is real just because it looks familiar. Scammers are incredibly good at impersonating banks, school fundraisers, online stores—or even your own spouse or child. They’ll craft emails or texts that create urgency (“your account is locked,” “donate now,” “I’m in trouble”) to trick you into sending money or sharing personal info.

Fix it:

Make it a house rule: never trust financial requests that come through email, text, or DMs—verify first. Call the person directly, log into your account manually (not through a link), or check with a second source. Teaching your family to slow down and verify can prevent some of the most emotionally manipulative online financial security mistakes.

4. Letting Devices Fall Behind on Security

Why it matters:

Outdated phones, tablets, and laptops are one of the sneakiest online financial security mistakes families make. These devices may run old software with unpatched vulnerabilities that criminals can exploit to install spyware, steal login credentials, or intercept online transactions—especially if those devices are used for banking, shopping, or bill pay.

Fix it:

Don’t let your tech fall behind. Turn on automatic updates for all operating systems and apps, and uninstall anything you no longer use. Prioritize securing devices tied to finances by enabling full-device encryption, using antivirus tools, and teaching your family to avoid sketchy downloads. Avoiding these common online financial security mistakes doesn’t require fancy tools—just good digital hygiene.

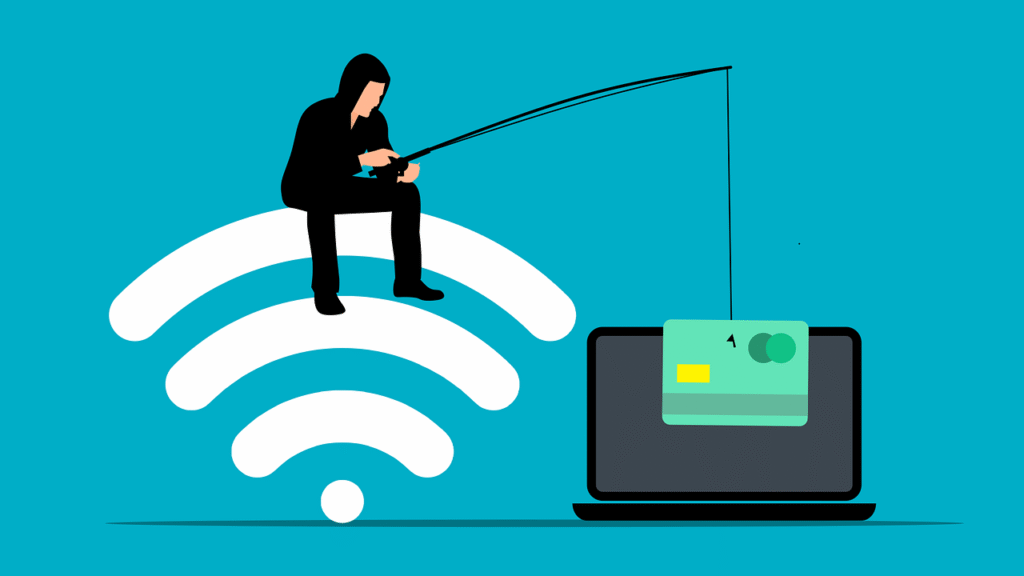

5. Banking on Public Wi-Fi Without Protection

Why it matters:

Accessing your bank or credit card apps while sipping coffee at a café might feel convenient—but it’s also one of the riskiest online financial security mistakes. Public Wi-Fi networks are often unsecured, making it easy for hackers to intercept your internet traffic, steal login credentials, or inject malware into your device.

Fix it:

Avoid conducting financial transactions over public Wi-Fi unless you’re using a VPN to encrypt your connection. Families can extend their home network protection on the go by remotely connecting to their Bison SafeFilter, ensuring secure browsing and blocking malicious sites even when away from home. Avoiding these common online financial security mistakes for families means thinking ahead—before you hit “Pay Now” in a hotel lobby.

6. Clicking Links in Fake “Bank” or “Tax” Emails

Why it matters:

Phishing scams remain one of the most common and dangerous online financial security mistakes families make. Cybercriminals craft convincing emails that appear to come from your bank, the IRS, or other trusted institutions, tricking you into clicking malicious links or downloading harmful attachments. These attacks can lead to stolen credentials, identity theft, or malware infections that compromise your entire financial life.

Fix it:

Never click links or download attachments from unsolicited financial emails. Instead, open a new browser window and navigate directly to your bank or tax authority’s official website. Teach your family members—including kids and elderly relatives—how to recognize suspicious emails by checking sender addresses, looking for spelling errors, and being wary of urgent language or threats. Avoiding these online financial security mistakes starts with awareness and caution.

7. Forgetting to Freeze Credit or Monitor Breaches

Why it matters:

One of the most costly online financial security mistakes families make is neglecting credit freezes and breach monitoring. When sensitive information like a child’s Social Security number or a senior parent’s financial data leaks in a breach, criminals can open fraudulent accounts, loans, or credit cards in their name—sometimes going unnoticed for years and causing serious financial harm.

Fix it:

Take proactive control by freezing credit reports with all three major bureaus: Equifax, Experian, and TransUnion. This stops new accounts from being opened without your consent. Additionally, sign up your family for identity monitoring services such as Lifelock, which provides real-time alerts if your personal or financial information is exposed. These steps are critical to avoid the severe consequences of common online financial security mistakes and protect your family’s financial future.

8. Weak Email Security (Your Most Important Account)

Why it matters:

Your email account is the master key to your entire digital life—especially when it comes to finances. If cybercriminals gain access to your email, they can reset passwords, intercept sensitive financial communications, and lock you out of banking, shopping, and investment accounts. Weak email security is one of the most damaging online financial security mistakes families can make.

Fix it:

Protect your email like it’s Fort Knox. Use a strong, unique password stored securely in a trusted password manager such as Bitwarden. Always enable two-factor authentication (2FA) using an authenticator app like Authy or Google Authenticator for the strongest protection—avoid SMS-based codes whenever possible. For added security, consider using a separate email address exclusively for financial accounts and transactions to minimize risk. Strengthening your email security is a cornerstone of preventing common online financial security mistakes and safeguarding your family’s money.

9. Leaving Kids and Parents Out of the Conversation

Why it matters:

One of the most overlooked online financial security mistakes families make is excluding key members—like kids and elderly parents—from cybersecurity conversations. A child’s gaming account, a grandparent’s tablet, or a spouse’s online shopping profile can all serve as vulnerable entry points for financial attacks. Hackers often exploit these less-secure accounts to gain access to your family’s financial ecosystem.

Fix it:

Remember, avoiding common online financial security mistakes works best when your whole family is involved. Create a clear Family Cybersecurity Plan and hold a monthly “Family Digital Check-In” to review passwords, share recent scam alerts, and teach everyone how to spot suspicious activity. Equip kids, parents, and elders with easy, age-appropriate tools and tips—like using password managers, enabling MFA, and spotting phishing attempts. By keeping your family informed and engaged, you drastically reduce the chance of costly online financial security mistakes and build a safer digital home.

Bonus: Common Scams That Target Families

- “Grandparent” scams – Callers pretend to be a grandchild in trouble asking for money.

- School payment scams – Fake invoices for sports trips or book fees.

- Online marketplace fraud – Fake buyers or sellers trick you out of money or items.

- Streaming subscription renewal phishing – Fake notices saying “your account is expiring” with links to spoofed sites.

Final Thoughts: Strong Habits Save Dollars and Sanity

The most costly cyberattacks rarely begin with high-tech hacks—they usually stem from simple, common online financial security mistakes families make every day.

The good news? Every one of these mistakes is avoidable with the right knowledge and tools.

By building strong digital habits, adopting effective tools, and making online financial security for families a shared priority, you protect not only your money but your identity and peace of mind.

Take Control of Your Digital Safety

At Bison Security Co., we believe strong cybersecurity starts at home—and grows with you. Whether you’re a parent, professional, or small business owner, we’ve got your back with the tools and support you need to stay safe in a connected world.

Here’s How to Get Started:

- Protect Your Home Network — Learn about Bison SafeFilter and block threats before they reach your devices.

- Test Your Scam-Spotting Skills — Take our Family Phishing Quiz and see how ready your household really is.

- Stay Cyber-Smart — Subscribe to our newsletter for weekly safety tips, family-friendly checklists, and early alerts.

- Tune In to the Podcast — Coming soon: honest, practical conversations about digital safety for modern families.

Security That Stands Its Ground.